To build up a library is to create a life. It’s never just a random collection of books.

Z-Library

1

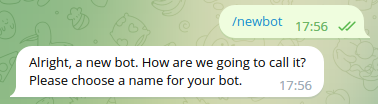

Follow this link or find "@BotFather" bot on Telegram

2

Send /newbot command

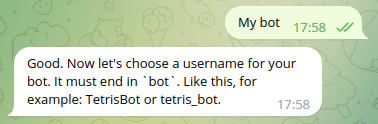

3

Specify a name for your chatbot

4

Choose a username for the bot

5

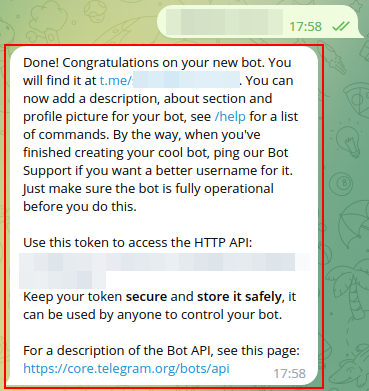

Copy an entire last message from BotFather and paste it here